The Most Embarrassing Venture Capital Write-Down of All Time: How Sequoia lost $214M on FTX and Did Not Hold Anyone Accountable

EXCLUSIVE: The spiciest diligence report you will ever read about Sequoia's disastrous investment in FTX, one of the largest write-downs in venture capital history

Comrades: The collapse of FTX makes Theranos look like child’s play. I have seen many cringeworthy episodes in clown world, but it’s hard to top this one which is why burnt the midnight oil for this bonus post. Instead of wasting money on business rags who get conned, please consider a paid subscription here.

FTX is a crypto trading platform that went from a $30 billion valuation to $0 over the past year. The incompetence and fraud will be unraveled for years to come. Michael Lewis was already embedded with the team to write another best-seller about crony capitalism run amok; Jonah Hill should clear his schedule to play SBF in a Netflix show.

Most articles I’ve read about FTX are analyzing the mechanics of how it imploded, but they are not going deep on the characters involved because that would be politically incorrect. Have no fear, Yuri is here! It is the perfect story to dissect that includes pattern recognition, crony elitism, and physiognomy. The diligence below will grow more savage as you keep reading.

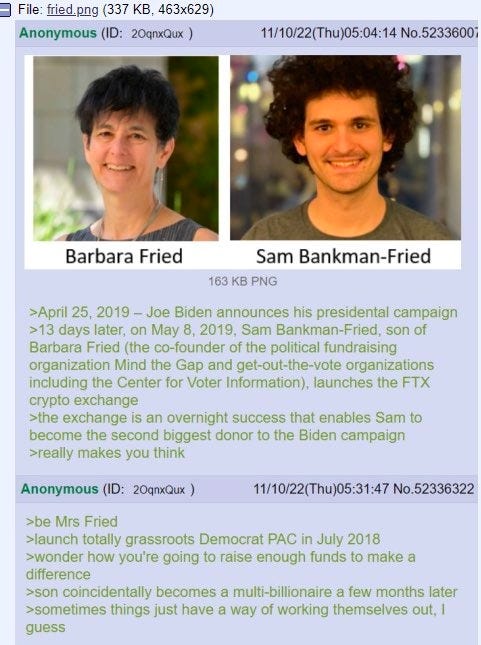

FTX CEO Sam Bankman-Fried (SBF) is the quintessential soy bugman. Rule of thumb - never trust a vegan who wears cargo shorts with white socks. His parents were Stanford professors and his mother is a Democrat NGO bundler. SBF funneled $50 million to Democrats in this midterm cycle, second only to the perennial heavyweight George Soros. “Effective altruism” + “democracy” = stealing from people to give to Democrats. He also fraudulently transferred FTX customer money into his own hedge fund Alameda, run by soy bugwoman ex-girlfriend Caroline Ellison.

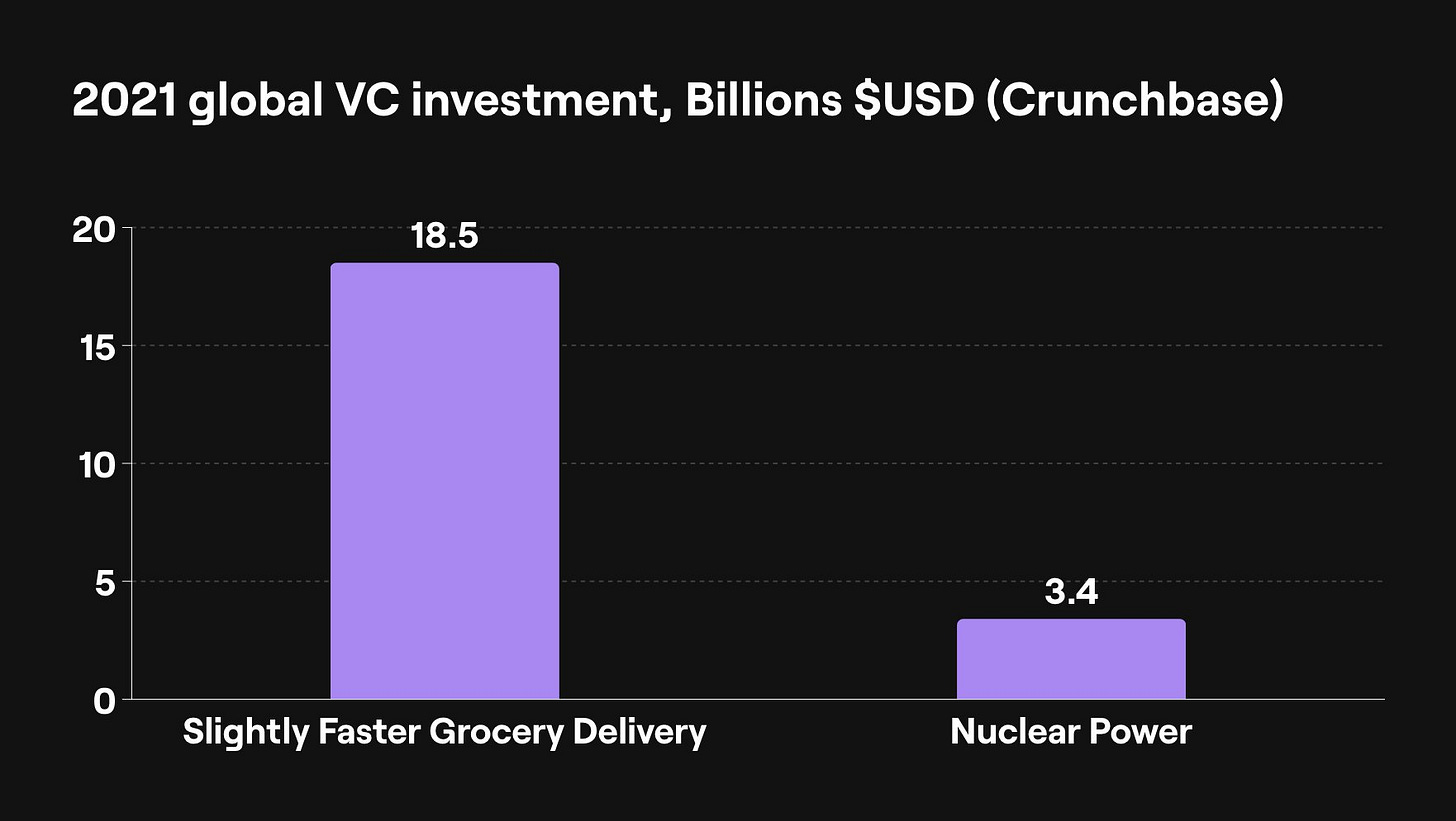

The most underreported part of this tale is on the other side of the table - the investors. Sequoia is regarded as the one of the greatest venture capital firms of all time with a storied history of grand slams including household names like Apple, Cisco, Google, Instagram, LinkedIn, PayPal, Reddit, Tumblr, WhatsApp, and Zoom. It has $85 billion in assets under management. Roloef Boetha is its well-respected leader, who was part of the legendary Paypal Mafia that included Elon Musk, Peter Thiel, David Sacks, and Keith Rabois.

At the peak of the bubble in Summer 2021, Sequoia plowed $214 million into FTX. As is custom with smug VCs, they announced their investment with a 13,000 word epic of self-congratulatory masturbatory propaganda fellating the brilliance of SBF. They have deleted the piece from their website to hide their embarrassment, but the internet never forgets and archived it in full here. The worst moment came when the partners were simping over SBF’s pitch, while he was simultaneously playing a video game. After Sequoia wrote down its investment in FTX to $0, it wrote a sobering memo to its own investors.

How it started:

How it’s going:

How did such a great fund get duped into making such a terrible investment? As noted in their memo, the partner who sourced the deal was Michelle Bailhe Fradin (MBF). She swooned in the heat of arousal chasing SBF:

“We were incredibly impressed,” Bailhe says. “It was one of those your-hair-is-blown-back type of meetings.”

MBF graduated from the #4 most demoralized Ivy League university in 2015, then worked at commissar grooming factories McKinsey and Google for a few years. It is rare for anyone under 30 to make partner at a VC firm with no previous VC or startup experience, much less one as impressive as Sequoia. I will bet you $214 million that she won’t get fired for losing $214 million, even though she staked her reputation on FTX. Why?

Yuri original meme:

MBF is one of the most predictable NPCs I have ever come across. I did more diligence on her social media than she did on FTX. Her LinkedIn is a cringey flex.

Pronouns? Check. Not looking at the camera because she’s better than you inferior plebes? Check.

Quantifying accomplishments from college? A graduation speech unironically titled “I Don’t Know”? Check, check.

Stunning and brave activism? Check.

What would possess anyone to publicly Tweet their wedding photo with the corniest caption possible? I will never understand. Sequoia’s investors paid for this cringe:

MBF created this meme about SBF, demonstrating once again that the left can’t meme:

If you somehow haven’t gagged yet, her Sequoia biography will churn your stomach. It screams “I’m a rich girl, but in the coolest way possible!”

The last 5 minutes of her interview on FTX podcast aged like milk - “OMG FTX SBF, speed is a superpower!”

In the startup/VC world, there is a shared ethos that failure is part of the risk-taking and learning process. Failure should be celebrated, not shamed. That does not apply here. FTX and Sequoia violated that oath in every way possible and deserve all the shame and ridicule they get. Founders have a duty not to lie or commit criminal behavior. Investors have a duty to conduct thorough diligence and avoid NPC groupthink. Once Sequoia cannonballed into the FTX pool, the rest of the party drunkenly hopped in - Blackrock, SoftBank, Tiger, Insight, NEA, IVP, Iconiq, Third Point, Altimeter, Lux, Mayfield, Lightspeed, Ribbit, Temasek, as well as celebrity sportsball stars Tom Brady and Steph Curry. Pour one out for Tom Terrific, between FTX and Giselle it’s been a tough month.

The net results: FTX, Sequoia, and every elite institution involved in this farce materially changed the outcome of an election cycle, laundered money through Ukraine that prolonged a war which has killed tens of thousands while displacing millions, and wiped out ~$10 billion from pension funds and retail customers. All while being promoted by the WEF Wehrmacht and having a higher ESG score than Exxon.

As of this writing, SBF is “under supervision” by law enforcement in the Bahamas. Along with Pfizer jabs, this will be the trial and scam of the century. Will SBF get Epstein’d because he is in too deep? Or will he get off easy like Elizabeth Holmes? Will he manage to escape to Dubai or Argentina? Is this all a giant psyop troll by the incestuous elites? Twitter and the Chief Twit are uncovering how deep the rabbit hole goes, but one thing is for sure - reality has become far more absurd than anything Hollywood can produce.

Frank Sobotka in The Wire summed it up 20 years ago:

Excellent piece, Yuri. This story should be front page, above-the-fold news in every major rag this week and for months going forward. I’m hoping it’s just too big to bury. Reading and researching this story can take my mind off the sham of an election we just had here in AZ. 🤬

Incessant upspeak? Check.