Three-letter disasters: How ESG and DEI destroyed SVB and capitalism as we know it

Yuri's spicy commentary on the implosion of Silicon Valley Bank (SVB), as told through cringe LinkedIn flexes, Twitter shitposts, and memes

Comrades: How did SVB go bankrupt? Slowly through cringe, then all at once through memes.

In Part 1 of How To Flex on LinkedIn, I provided tips on making your profile shine and spotting red flags. In How To Build a Killer Business (Part 3), I predicted several high profile startups would fail during this downturn. I could never have imagined that the country’s 16th largest bank, which was the financial backbone of the tech industry, would go belly up in days as the second largest bank failure in US history.

Before it went under, SVB had amassed $200+ billion in assets and 8,000+ employees. Half of all VC-backed companies banked with them, including hundreds of climate tech startups. 100,000+ employee paychecks were at stake, the vast majority of them Democrat voters. If this were a flyover state farmer’s bank, it would probably get the East Palestine treatment.

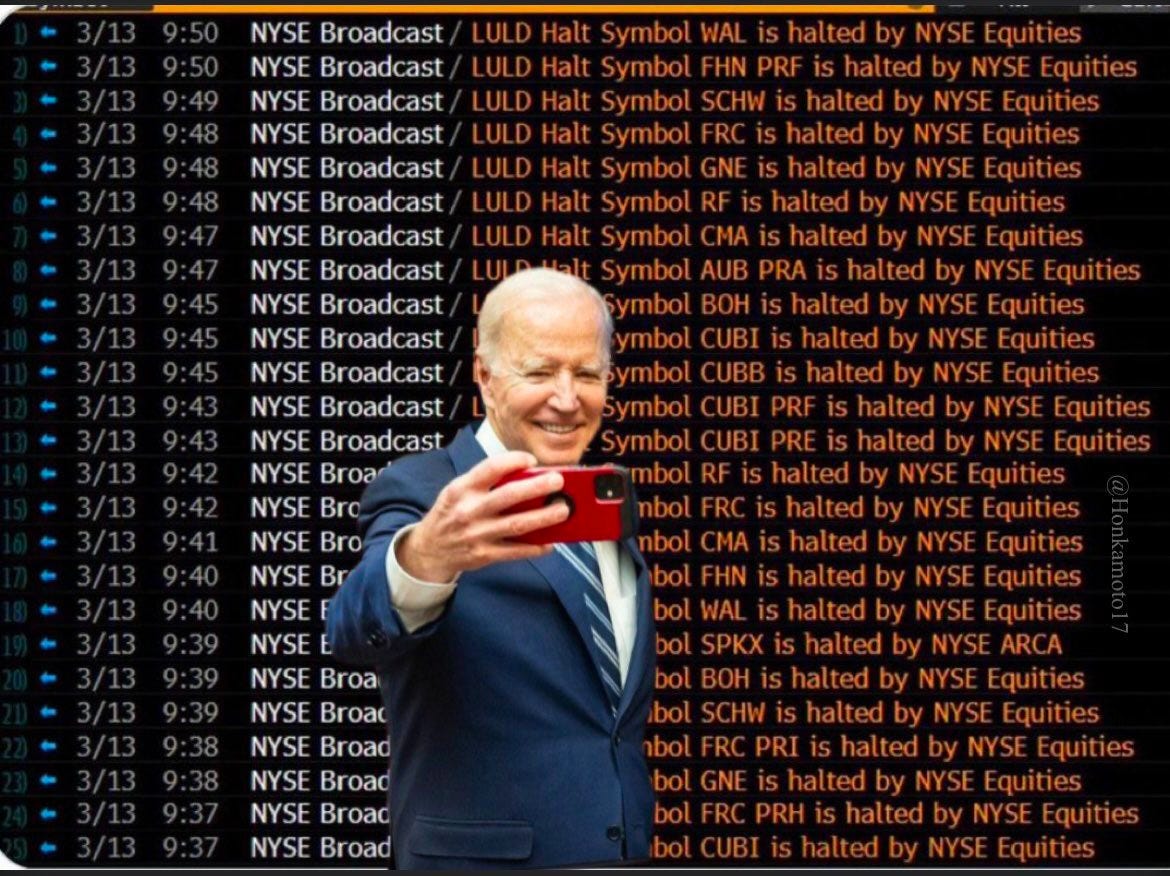

As sure as the sun rises in the east and sets in the west, The Swamp came to the rescue of its donor base in The Valley. On Sunday, The Fed stepped in to backstop SVB’s depositors in full. It also shut down another bank in the process - Signature Bank, where Barney Frank of Dodd-Frank is on the board. The Fed declared that taxpayers are not on the hook for this help, but does anyone believe that? Following President Teleprompter’s Monday morning bumbling that our banking system is safe, several bank stocks crashed to the point where trading was halted. As of this writing, fears of contagion remain.

Many fine publications have analyzed the technical components of the SVB collapse (TLDR: SVB did not understand Econ 101 interest rate risk, startup CEOs/CFOs/VCs did not understand Econ 101 concentration risk and FDIC insurance limits). Like the FTX/SBF disaster where Sequoia lost $214 MILLION and account holders lost billions, I will take you through the human side of the fiasco. The patterns to recognize are as follows:

Institutions are comprised of people. When the people running them are clowns, the institutions become clown cars and our society becomes clown world. We now live in a low-trust, low-confidence third-world country.

As with COVID and climate, the “elites” win and everyone else loses. No one will go to jail or have their salaries clawed back. SVB paid out employee bonuses right before it was shut down. Big banks like Goldman Sachs, JP Morgan, and Bank of America that are already too big to fail will get even bigger because of the capital flight to perceived safety.

ESG and DEI are cancers that ZIRP metastasized. The data is now clear that companies adopting ESG perform worse than those who don’t. Anyone who continues working in these “professions” is a grifter who should be ridiculed and shamed. Like Yuri’s stages of demoralization, the economic damage from ESG/DEI spreads over 3 stages:

Stage 1: commissar salaries and time wastage of ESG/DEI reporting and mandatory struggle sessions (millions of dollars per company)

Stage 2: distraction from core mission, operations, and profitability (billions of dollars per company)

Stage 3: corrupt cronyism and public’s loss of trust in all institutions (trillions of dollars plus societal demoralization)

Like the 2008 Global Financial Crisis bailouts, the government will incentivize more moral hazard. Plugging holes in the short term will lead to bigger holes and disasters in the long term. SVB is too woke to fully fail.

If Forbes and Jim Cramer are bullish, you should be bearish:

SVB has deleted several of its social media pages, but I have saved the receipts below. Although LinkedIn is a public network, my privacy policy is to show names of c-suite executives but hide names of rank and file. I used to work in both the finance and tech industries and know many people who are directly affected by this chaos, so this one hits close to home.

Follow me on Twitter here, amplify this article, and protect the memesmiths.

Now onto the clown show…

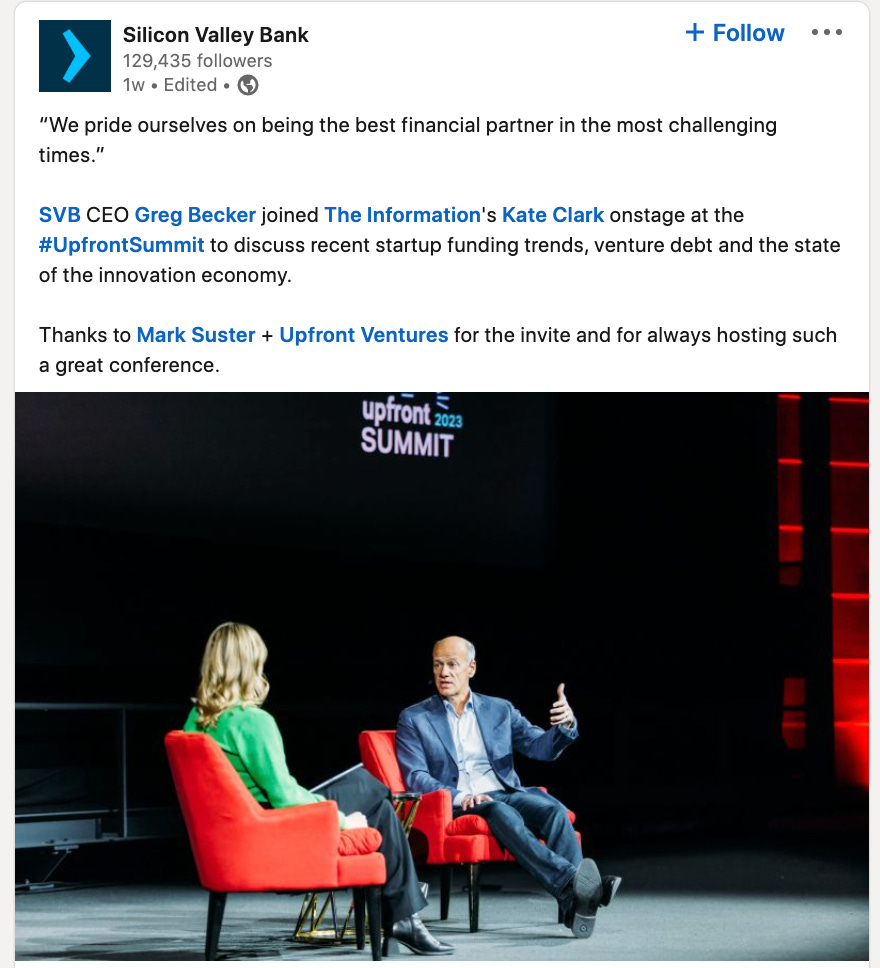

A week before SVB imploded, its CEO Greg Becker was featured in a self congratulatory fireside chat at the Upfront Summit. The Information was founded Jessica Lessin, the daughter of TPG private equity mogul Jerome Vascellaro. It’s a great big club and you ain’t in it. The “journalist” asked him softball questions like how he relieves stress (biking), but not a single tough one about why he recently sold $3.6 million in stock or his conflict of interest as a board member of the Federal Reserve Bank of San Francisco:

The Upfront Summit is the ultimate woke tech gathering, during which Upfront founder Mark Suster publicly circle jerks as many people as possible. Was the hilarious Silicon Valley “dick jerk algorithm” scene inspired by him?

Days after the summit, Suster vociferously defended SVB as rumors of its insolvency spread. I asked him if he had any conflict of interest and was promptly blocked. He joins Noah Smith, Heather Cox Richardson, and Scott Galloway on the list of people who have blocked Yuri:

Once again, history is repeating. SVB’s Chief Administrative Officer was CFO at Lehman Brothers right before it collapsed in 2008:

The main job of a bank is to manage risk. SVB managed risk as well as Biden managed the Afghanistan withdrawal. Why? SVB did not have a Chief Risk Officer for almost a year leading up to its unravelling (May 2022 to January 2023). Its current Chief Risk Officer Kim Olson deleted her LinkedIn. She previously worked at institutions known for poor risk management: AIG, Deutsche Bank, and the Federal Reserve. Why was there such a long vacancy in such a critical role? Were diversity quotas in place to reduce the quality and quantity of the candidate pool? I highlighted the ironic part of her bio:

In the interim, the most senior risk officer appeared to be this intersectional yas kween across the pond:

As is the case in most man-made disasters, ESG was embedded into SVB:

Sustainable Finance and Carbon Neutral Operations did not result in a Healthier Balance Sheet:

SVB’s sanctimonious ESG commissar does not have pronouns in her bio and should be fired for not being ESG enough:

Here is what the busybody job entails:

Reminder - DEI is a small billion-dollar cottage industry within the multi-trillion dollar ESG behemoth:

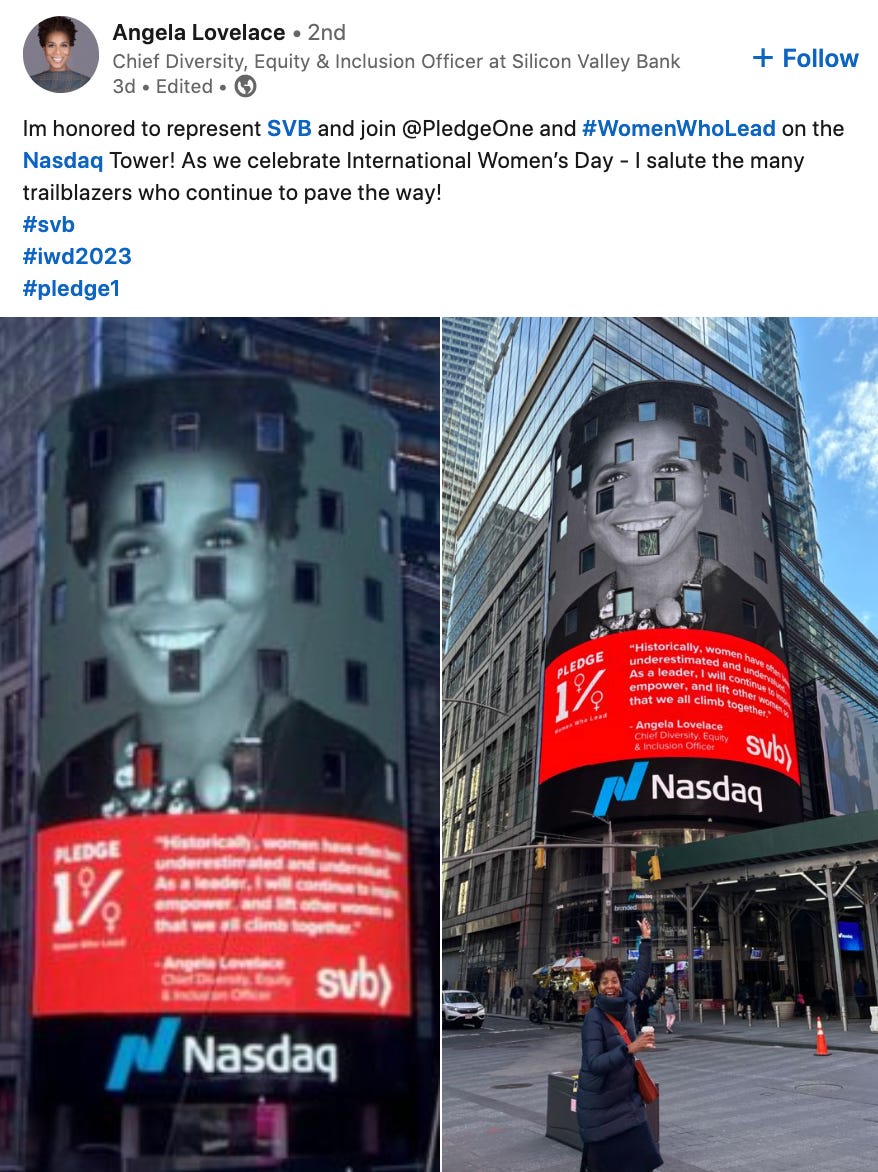

SVB’s DEI Commissar (she/her) is exactly what you’d expect:

Here she is bravely virtue signaling on an expensive business trip, just days before the implosion:

Nike’s new Head of DEI was fired by Elon from the same job at Twitter. Will he say a word about Nike’s inclusion of CCP slave labor in its manufacturing and supply chain? Perhaps I should recruit him for my Current Thing Company:

He has the most nauseating bio I have ever read:

Rule of thumb - the more someone woke flexes in public, the worse they are in private. The poster of this stunning and brave IWD tribute was a well known creep in college:

As Yuri said, demoralization is followed by crisis and normalization. Prepare for the worst, but hope for the best:

I'm not a "finance person", nor am I a "money man", but if anyone can reasonably and sensibly explain how investing in ESG can monitarily benefit a company, I'd really appreciate it.

I don't like to take anyone's word at face value, but from everything that I've read, it seems like throwing money at high-risk environmental start-ups, placing diversity hires in the upper echelon of your business without merit, and giving money to charity all seem like unsound business practices.

For years to come, these ignominious twits will be written about in books and history lessons about how too much Woke results in most definite Broke.

Congratulations, you are all famous. So famous, you are infamous.....